ISTANBUL

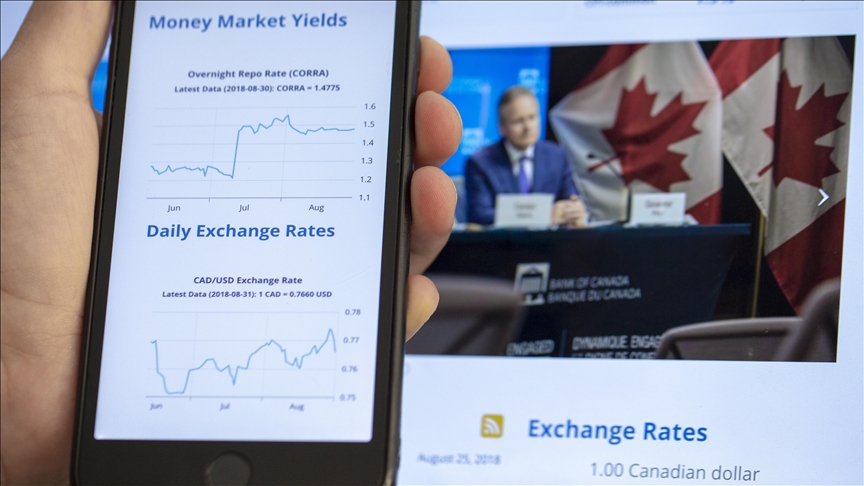

The Bank of Canada on Wednesday kept interest rates unchanged, and said it continues its policy of quantitative tightening.

The target for the overnight rate was maintained at 5%, with the bank rate at 5.25% and the deposit rate at 5%.

“Global economic growth continues to slow, with inflation easing gradually across most economies,” the central bank said in a statement.

It said that Canada’s economy has stalled since the middle of 2023 and growth will likely remain close to zero through the first quarter of 2024.

The central bank, however, added that economic growth is expected to strengthen gradually around the middle of this year as household spending would pick up and exports and business investment should get a boost from recovering foreign demand.

The “CPI inflation ended the year at 3.4%. Shelter costs remain the biggest contributor to above-target inflation. The Bank expects inflation to remain close to 3% during the first half of this year before gradually easing, returning to the 2% target in 2025,” said the statement.

Canada’s annual consumer inflation increased to 3.4% in December 2023, from a gain of 3.1% in November. The rate, however, is still significantly lower than the 8.1% figure in June 2022, which was the highest in 39 years.

The bank stressed that its Governing Council wants to see further and sustained easing in core inflation, and continues to focus on the balance between demand and supply in the economy, inflation expectations and wage growth.

“While growth in the United States has been stronger than expected, it is anticipated to slow in 2024, with weakening consumer spending and business investment,” the statement said. “In the euro area, the economy looks to be in a mild contraction. In China, low consumer confidence and policy uncertainty will likely restrain activity.”

The Bank of Canada said it now forecasts global GDP growth of 2.5% in 2024 and 2.75% in 2025, following 3% in 2023, adding: “With softer growth this year, inflation rates in most advanced economies are expected to come down slowly, reaching central bank targets in 2025.”

In Canada, consumers have pulled back their spending as a response to higher prices and interest rates, while business investment has contracted, according to the central bank.

Overall supply has caught up with demand due to weak growth, while Canada’s economy now looks to be operating in modest excess supply, it added.

Labor market conditions, meanwhile, have eased with job vacancies returning close to levels before the coronavirus pandemic, but new job creations are at a slower rate than population growth, it said.

Wages, however, are still rising around 4% to 5%, according to the Bank of Canada.