By Anadolu Agency

WASHINGTON

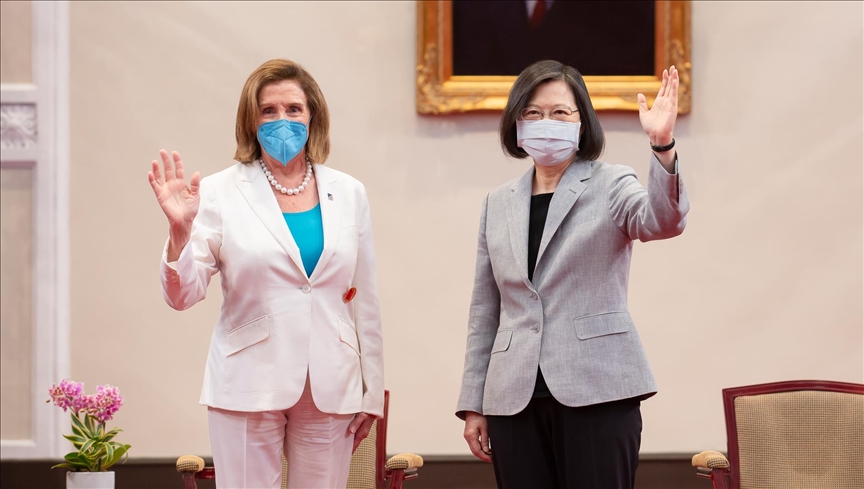

US House Speaker Nancy Pelosi’s visit to Taiwan, which is in a sovereignty conflict with China, has raised the perception of geopolitical risk in the markets, according to analysts.

Pelosi’s visit became the first one by a speaker of the US House of Representatives in 25 years. After the plane carrying Pelosi and a five-member congress delegation arrived in Taiwan on Tuesday, harsh statements came from China.

China’s Foreign Ministry said in a statement that the visit, despite Chinese opposition and protests, seriously violated the principle of “one China” and the commitments in the Three Joint Declarations that form the basis of China-US diplomatic relations. Beijing views Taiwan as a “breakaway province” and has vowed to reunify it with the mainland, including by force if necessary.

With these developments, Asian stock markets fell sharply, while the Shanghai Composite index was down 2.26%, the Nikkei 225 index 1.4% in Japan, the Kospi index 0.52% in South Korea, and the Hang Seng index 2.67% in Hong Kong.

In Taiwan, which is at the center of geopolitical discussions, the index also decreased by 1.56%.

Tensions between the US and China also increased the pressure on the currencies of China and Taiwan, with the Taiwan dollar at its lowest level since May 2020.

The Japanese yen, on the other hand, rose slightly against the dollar due to the safe-haven effect.

The dollar/yen parity increased by 0.53% to 132.3 as of 1600GMT.

Mixed course in New York stock market

The New York stock market is also following a mixed course after the day started with a decline.

At the opening, the Dow Jones index lost 0.33%, the S&P 500 index 0.35%, and the Nasdaq index 0.66%, while S&P 500 and Nasdaq indices showed upward movements after the opening.

With the increasing tension between the US and China over Taiwan, the dollar index and gold rose.

The dollar index rose by 0.47% to 105.8 as of 1600GMT while an ounce of gold also climbed to $1,793.80 with an increase of 0.35%.

The US 10-year bond yield, on the other hand, followed an upward trend and rose to 2.7%.

European stock markets

On the European side, the steps to be taken by the European Central Bank in the face of the ongoing Russia-Ukraine war, energy crisis, and high inflation remained at the center of the agenda.

According to analysts, the tense relations between the US and China could deteriorate with Pelosi’s visit at a time when there were already concerns about the global economic recession.

Germany’s DAX 40 index lost 0.23%, CAC 40 index 0.42% in France, and Italy’s FTSE MIB 30 index lost 0.35%.

In the UK, the FTSE 100 index decreased by 0.06%.

The euro/dollar parity declined after testing the 1.03 level, the highest level in about a month, and traded at 1.02 with a decrease of 0.53%.

We use cookies on our website to give you a better experience, improve performance, and for analytics. For more information, please see our Cookie Policy By clicking “Accept” you agree to our use of cookies.

Read More